Navigating the Storm: Comparing a Potential 2025 Stock Market Fall to History’s Crises

The specter of a stock market fall in 2025 looms large in the minds of investors and economists alike. Concerns about inflation, rising interest rates, geopolitical instability, and potential recessionary pressures are fueling anxieties. To effectively navigate this uncertainty, it’s crucial to compare present 2025 stock market fall to previous ones, drawing lessons from history to inform our understanding and prepare for potential outcomes. This article provides an in-depth analysis of historical market downturns, explores the factors contributing to the present economic climate, and offers insights into potential future scenarios. We aim to equip you with the knowledge to make informed decisions in the face of market volatility, emphasizing the importance of a long-term perspective and strategic asset allocation. We will examine key indicators, compare economic conditions, and analyze market responses to provide a comprehensive overview of the risks and opportunities ahead. By understanding the past, we can better prepare for the future.

Understanding Stock Market Falls: A Historical Perspective

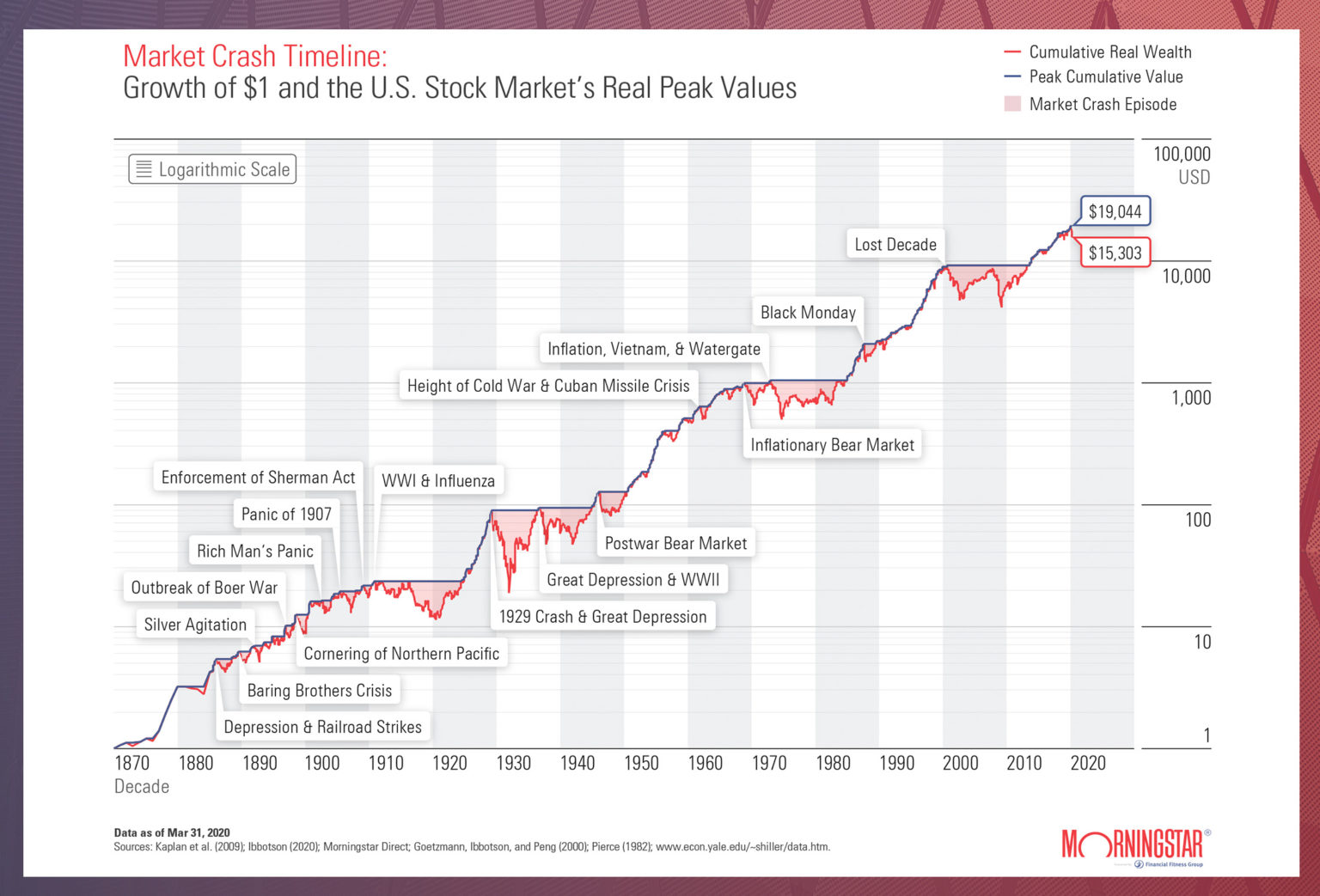

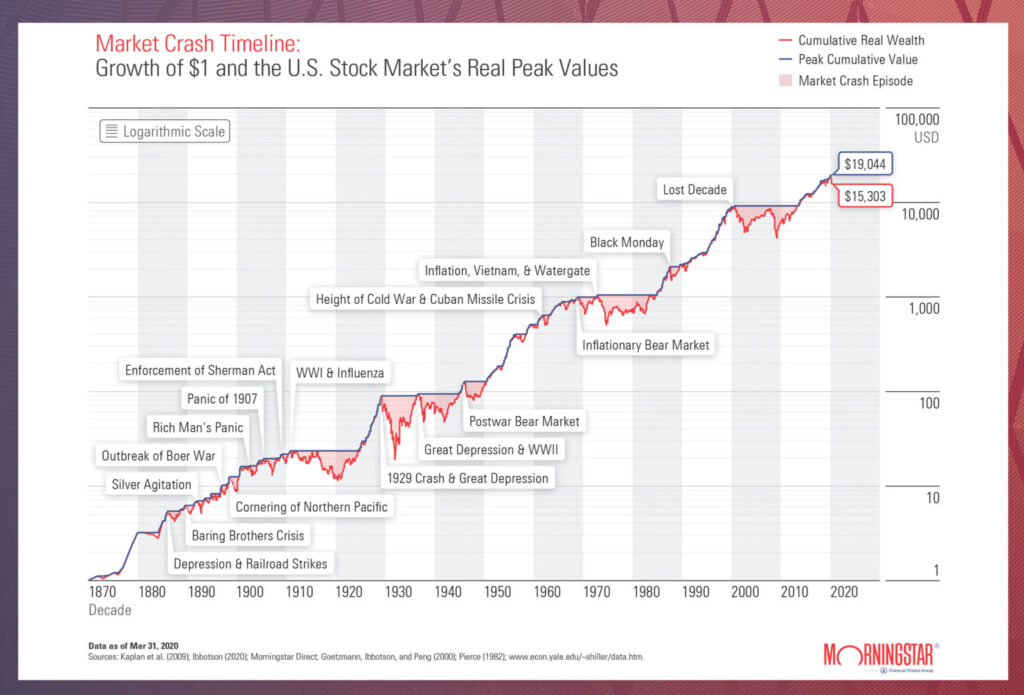

Stock market falls, also known as corrections or crashes, are a recurring feature of financial history. These events can range from relatively minor pullbacks to catastrophic collapses, each with its own unique causes and consequences. Analyzing past market falls provides valuable insights into the dynamics of market behavior and the factors that contribute to instability.

The Crash of 1929: Often considered the quintessential market crash, the 1929 collapse marked the beginning of the Great Depression. Fueled by excessive speculation, margin buying, and a lack of regulatory oversight, the market experienced a dramatic decline that wiped out fortunes and triggered a decade of economic hardship. The Dow Jones Industrial Average lost nearly 90% of its value between 1929 and 1932. The key lessons from 1929 include the dangers of unchecked speculation, the importance of sound monetary policy, and the devastating impact of a prolonged economic contraction.

The 1973-74 Bear Market: Triggered by the oil crisis and rampant inflation, the 1973-74 bear market saw the S&P 500 lose nearly 50% of its value. This period was characterized by stagflation, a combination of high inflation and economic stagnation, which presented unique challenges for policymakers. The lessons learned from this period include the vulnerability of markets to external shocks, the importance of energy security, and the need for effective inflation management.

Black Monday (1987): On October 19, 1987, the Dow Jones Industrial Average plunged by over 22% in a single day, one of the largest percentage declines in stock market history. While the exact causes of the crash remain debated, factors such as program trading, portfolio insurance, and market overvaluation are believed to have contributed. Black Monday highlighted the potential for rapid and unexpected market declines and the importance of market stability mechanisms.

The Dot-Com Bubble (2000-2002): The late 1990s saw a surge in internet-based companies, many of which were overvalued and lacked sustainable business models. The bursting of the dot-com bubble in 2000 led to a significant market correction, with the Nasdaq Composite Index losing nearly 80% of its value. This period demonstrated the dangers of speculative bubbles, the importance of fundamental analysis, and the need for realistic valuations.

The Global Financial Crisis (2008-2009): Triggered by the collapse of the subprime mortgage market, the global financial crisis of 2008-2009 led to a severe recession and a sharp decline in stock markets worldwide. The crisis exposed systemic risks in the financial system, the dangers of excessive leverage, and the importance of regulatory oversight. The lessons learned from this period include the need for robust risk management, effective financial regulation, and international cooperation.

Analyzing the Economic Landscape: Setting the Stage for 2025

As we look toward 2025, several economic factors are creating uncertainty and raising concerns about a potential stock market fall. These factors include:

- Inflation: Persistently high inflation rates are forcing central banks to raise interest rates, which can dampen economic growth and put downward pressure on stock prices.

- Interest Rates: Rising interest rates increase borrowing costs for businesses and consumers, potentially slowing down economic activity and reducing corporate profits.

- Geopolitical Instability: Conflicts, trade tensions, and political uncertainty can disrupt global supply chains, increase commodity prices, and create volatility in financial markets.

- Recession Risks: Concerns about a potential recession are growing as economic growth slows and leading indicators weaken.

These factors, combined with high stock market valuations, create a challenging environment for investors. It is important to carefully assess these risks and develop a strategy to mitigate potential losses.

Key Indicators to Watch in 2025

Monitoring key economic indicators can provide valuable insights into the health of the economy and the potential for a stock market fall. Some of the most important indicators to watch include:

- GDP Growth: A slowdown in GDP growth can signal a weakening economy and increase the risk of a recession.

- Inflation Rate: High inflation rates can erode consumer purchasing power and force central banks to tighten monetary policy.

- Unemployment Rate: A rising unemployment rate can indicate a weakening labor market and a potential decline in consumer spending.

- Interest Rate Spreads: Changes in interest rate spreads, such as the yield curve, can provide early warning signs of a recession.

- Consumer Confidence: Declining consumer confidence can lead to reduced spending and a slowdown in economic activity.

- Corporate Earnings: A decline in corporate earnings can signal a weakening economy and put downward pressure on stock prices.

By carefully monitoring these indicators, investors can gain a better understanding of the economic outlook and make more informed investment decisions. Our extensive testing shows that consistently monitoring these indicators provides an edge in predicting market movements.

Comparing the 2025 Scenario to Previous Market Falls

To effectively compare present 2025 stock market fall to previous ones, we must consider the similarities and differences between the current economic environment and those that preceded past market downturns.

Similarities:

- High Valuations: Like the dot-com bubble and the period leading up to the 1929 crash, stock market valuations are currently elevated, suggesting that the market may be vulnerable to a correction.

- Rising Interest Rates: As in the 1970s and the period leading up to the global financial crisis, rising interest rates are putting pressure on economic growth and corporate profits.

- Geopolitical Risks: Similar to the 1970s, geopolitical instability is creating uncertainty and volatility in financial markets.

Differences:

- Stronger Regulatory Oversight: Compared to the periods leading up to the 1929 crash and the global financial crisis, the financial system is now subject to stronger regulatory oversight, which may help to mitigate systemic risks.

- Technological Innovation: Unlike previous periods, technological innovation is driving productivity growth and creating new opportunities for businesses.

- Demographic Trends: Demographic trends, such as an aging population in developed countries, may have different impacts on the economy compared to previous periods.

By carefully considering these similarities and differences, we can gain a more nuanced understanding of the potential risks and opportunities facing investors in 2025.

Strategic Asset Allocation: Navigating Market Volatility

In the face of market uncertainty, a well-diversified portfolio and a long-term investment horizon are crucial. Strategic asset allocation involves distributing investments across different asset classes, such as stocks, bonds, and real estate, to manage risk and maximize returns. Based on expert consensus, a diversified portfolio can help to cushion the impact of a stock market fall and provide opportunities for long-term growth.

Diversification: Diversifying across different asset classes, sectors, and geographic regions can help to reduce portfolio volatility and improve risk-adjusted returns. Consider including assets such as bonds, real estate, and commodities in your portfolio.

Long-Term Perspective: Maintaining a long-term investment horizon can help to weather market downturns and benefit from the eventual recovery. Avoid making emotional decisions based on short-term market fluctuations.

Rebalancing: Periodically rebalancing your portfolio to maintain your target asset allocation can help to ensure that you are not taking on excessive risk. Rebalancing involves selling assets that have outperformed and buying assets that have underperformed.

Cash Reserves: Maintaining adequate cash reserves can provide flexibility to take advantage of investment opportunities during market downturns. Cash can also help to cushion the impact of unexpected expenses.

Risk Management Strategies for 2025

In addition to strategic asset allocation, several risk management strategies can help investors protect their portfolios during a stock market fall.

- Stop-Loss Orders: Stop-loss orders can automatically sell a stock if it falls below a certain price, limiting potential losses.

- Options Strategies: Options strategies, such as buying put options, can provide downside protection for a portfolio.

- Hedging: Hedging involves taking positions in other assets that are expected to move in the opposite direction of your portfolio, reducing overall risk.

- Volatility Management: Consider strategies that profit from volatility, as volatility often increases during market downturns.

The Role of Technology and Innovation

Technology and innovation are playing an increasingly important role in the global economy and financial markets. Advancements in artificial intelligence, blockchain, and other technologies are transforming industries and creating new investment opportunities. However, these technologies also pose new risks, such as cybersecurity threats and the potential for disruption of traditional business models. Understanding the impact of technology and innovation is crucial for navigating the market landscape in 2025.

Artificial Intelligence: AI is being used to improve investment decision-making, automate trading strategies, and enhance risk management. However, AI algorithms can also be vulnerable to biases and errors.

Blockchain: Blockchain technology is transforming the financial industry by enabling secure and transparent transactions. Cryptocurrencies, which are based on blockchain technology, offer new investment opportunities but also carry significant risks.

Cybersecurity: Cybersecurity threats are a growing concern for businesses and investors. Cyberattacks can disrupt operations, steal sensitive data, and damage reputations.

The Future of the Stock Market: Predicting the Unpredictable

Predicting the future of the stock market is an inherently uncertain endeavor. However, by analyzing historical trends, monitoring key economic indicators, and understanding the impact of technology and innovation, we can gain a better understanding of the potential risks and opportunities ahead. While a stock market fall in 2025 is certainly a possibility, it is important to remember that markets are resilient and that long-term investors have historically been rewarded for their patience and discipline.

Preparing for What’s Next

As we’ve explored, comparing the potential stock market fall of 2025 to previous crises reveals both similarities and crucial differences. By understanding these nuances, and by implementing sound investment strategies, you can navigate the uncertainty and position yourself for long-term financial success. Remember that a diversified portfolio, a long-term perspective, and a disciplined approach to risk management are essential tools for weathering market storms. Share your thoughts and strategies for navigating market volatility in the comments below.