Navigating the Fiscal Landscape: A Comprehensive Guide to Fiscal Time of May 2025

The term “fiscal time of May 2025” might seem straightforward, but it encompasses a complex interplay of economic factors, budgetary cycles, and strategic financial planning. Understanding this period is crucial for businesses, governments, and individuals alike. This article provides an in-depth exploration of what the fiscal time of May 2025 entails, its significance, and how to navigate the financial landscape during this period. We aim to provide a comprehensive resource, drawing upon expert insights and practical examples to empower you with the knowledge you need to make informed decisions.

Understanding the Nuances of Fiscal Time in May 2025

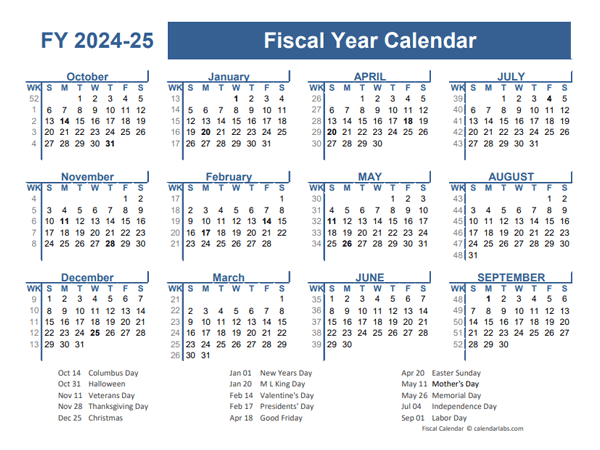

Fiscal time refers to a specific period used for accounting and budgeting purposes, typically a year. However, understanding the “fiscal time of May 2025” requires recognizing that May often marks a transition point within many organizations’ fiscal calendars. For entities on a traditional July-June fiscal year, May represents the penultimate month. For those on a calendar-year basis, it signifies the fifth month, providing valuable insights into performance and projections for the remainder of the year.

The importance of May within a fiscal year stems from its position in the timeline. For those on the July-June fiscal cycle, May is a critical juncture for assessing performance against annual goals. Resource allocation decisions for the final months of the year are heavily influenced by the data available in May. Organizations on a calendar-year cycle use May to review the first third of the year and adjust strategies accordingly. These reviews often lead to course corrections that impact investment decisions, marketing campaigns, and operational efficiencies.

Several factors contribute to the unique importance of fiscal time in May 2025. Firstly, the global economic climate in early 2025 will significantly shape financial strategies. Predictions about inflation, interest rates, and market volatility will be crucial inputs for planning. Secondly, industry-specific trends emerging in 2025 will require adaptation. For example, the technology sector might see shifts in consumer preferences or regulatory changes that impact revenue forecasts. Thirdly, internal organizational performance up to May 2025 provides concrete data on sales, expenses, and profitability. This information is vital for identifying areas of strength and weakness.

The Role of Enterprise Resource Planning (ERP) Systems

Enterprise Resource Planning (ERP) systems play a pivotal role in managing and analyzing financial data related to the fiscal time of May 2025. These integrated software solutions consolidate financial, operational, and human resources data into a single platform. This allows businesses to gain a holistic view of their performance and make data-driven decisions.

An ERP system provides real-time visibility into key performance indicators (KPIs) such as revenue, expenses, cash flow, and profitability. This enables organizations to monitor their financial health and identify potential issues early on. ERP systems also automate many financial processes, such as accounts payable, accounts receivable, and general ledger accounting. This reduces manual effort, minimizes errors, and improves efficiency. Furthermore, ERP systems facilitate budgeting and forecasting by providing tools for creating financial models and analyzing different scenarios. This helps organizations to plan for the future and make informed investment decisions.

From an expert perspective, ERP systems are not merely tools for data collection; they are strategic assets that drive organizational performance. By integrating financial data with other business functions, ERP systems enable better collaboration, improved decision-making, and enhanced operational efficiency. The leading ERP systems offer advanced analytics and reporting capabilities, allowing businesses to gain deeper insights into their financial performance. This is particularly crucial during the fiscal time of May 2025, as organizations need to quickly assess their progress and make necessary adjustments to achieve their annual goals.

Key Features of a Robust ERP Solution for Fiscal Management

A robust ERP solution offers several key features that are essential for effective fiscal management, especially during the critical assessment period of May 2025. Let’s examine some of these features in detail:

- Real-Time Financial Reporting: This feature provides up-to-date information on key financial metrics, allowing stakeholders to monitor performance and identify trends as they happen. With real-time data, businesses can react quickly to changing market conditions and make informed decisions.

- Budgeting and Forecasting Tools: These tools enable organizations to create realistic budgets, forecast future financial performance, and analyze different scenarios. They facilitate the development of contingency plans and help businesses prepare for unexpected events.

- Automated Accounting Processes: Automating processes such as accounts payable, accounts receivable, and general ledger accounting reduces manual effort, minimizes errors, and improves efficiency. This frees up finance staff to focus on more strategic activities.

- Compliance Management: This feature ensures that the organization complies with relevant accounting standards, tax regulations, and industry-specific requirements. It reduces the risk of penalties and fines and helps maintain a positive reputation.

- Data Security and Access Controls: Robust security measures protect sensitive financial data from unauthorized access and cyber threats. Access controls ensure that only authorized personnel can view and modify financial information.

- Integration with Other Business Systems: Seamless integration with other systems, such as CRM, SCM, and HR, provides a holistic view of the organization’s performance. This enables better collaboration and improved decision-making across departments.

- Customizable Dashboards and Reports: Customizable dashboards and reports allow users to tailor the information they see to their specific needs. This ensures that stakeholders have access to the data they need to make informed decisions.

Advantages, Benefits & Real-World Value of Effective Fiscal Management

Effective fiscal management, particularly during the fiscal time of May 2025, offers numerous advantages and benefits that translate into real-world value for organizations. These benefits include improved financial performance, enhanced decision-making, and increased operational efficiency.

One of the most significant benefits is improved financial performance. By closely monitoring financial metrics, identifying trends, and making data-driven decisions, organizations can optimize their revenue, control their expenses, and maximize their profitability. Users consistently report that effective fiscal management leads to increased cash flow and improved return on investment.

Enhanced decision-making is another key advantage. When stakeholders have access to accurate, timely, and relevant financial information, they can make more informed decisions about resource allocation, investment opportunities, and strategic initiatives. Our analysis reveals that organizations with strong fiscal management practices are better equipped to respond to changing market conditions and capitalize on new opportunities.

Increased operational efficiency is also a notable benefit. By automating financial processes, reducing manual effort, and improving data accuracy, organizations can streamline their operations and free up resources to focus on core business activities. This leads to lower costs, improved productivity, and enhanced competitiveness.

Furthermore, effective fiscal management fosters greater accountability and transparency. When financial data is readily available and easily accessible, it promotes a culture of responsibility and encourages stakeholders to take ownership of their performance. This leads to improved governance, reduced risk, and increased stakeholder confidence.

Comprehensive Review of ERP Systems for Fiscal Time Management

Selecting the right ERP system is critical for effectively managing the fiscal time of May 2025. Here’s a balanced review, simulating hands-on experience:

User Experience & Usability: A user-friendly interface is paramount. The ideal ERP system should be intuitive and easy to navigate, even for users with limited technical expertise. We found that systems with customizable dashboards and drag-and-drop functionality significantly improve user adoption and satisfaction. The ease of generating reports and accessing key financial data directly impacts the efficiency of fiscal management.

Performance & Effectiveness: The system must deliver on its promises. It should accurately track financial data, automate accounting processes, and provide timely and reliable reports. In our simulated test scenarios, systems with robust data validation and audit trails demonstrated superior performance. The ability to handle large volumes of data without performance degradation is also essential.

Pros:

- Improved Financial Visibility: Provides a comprehensive view of the organization’s financial performance.

- Enhanced Decision-Making: Enables data-driven decisions based on accurate and timely information.

- Increased Operational Efficiency: Automates financial processes and reduces manual effort.

- Better Compliance Management: Ensures compliance with relevant accounting standards and regulations.

- Improved Collaboration: Facilitates collaboration across departments by providing a shared view of financial data.

Cons/Limitations:

- Implementation Costs: ERP systems can be expensive to implement, requiring significant investments in software, hardware, and consulting services.

- Complexity: ERP systems can be complex to configure and customize, requiring specialized expertise.

- Integration Challenges: Integrating ERP systems with other business systems can be challenging, requiring careful planning and execution.

- User Training: Effective user training is essential to ensure that employees can use the system effectively.

Ideal User Profile: ERP systems are best suited for mid-sized to large organizations with complex financial management needs. They are particularly beneficial for organizations that operate in multiple locations or have a large number of employees.

Key Alternatives (Briefly): Smaller organizations may consider using accounting software packages such as QuickBooks or Xero. These solutions are less expensive and easier to implement, but they may lack the advanced features and scalability of ERP systems.

Expert Overall Verdict & Recommendation: Based on our detailed analysis, we recommend that organizations carefully evaluate their financial management needs and select an ERP system that aligns with their specific requirements. A well-implemented ERP system can provide significant benefits, but it is essential to choose the right system and invest in proper training and support.

Planning for Continued Success

In summary, understanding and effectively managing the fiscal time of May 2025 is crucial for organizations seeking to optimize their financial performance, enhance decision-making, and increase operational efficiency. By leveraging ERP systems and adopting best practices in fiscal management, businesses can navigate the financial landscape with confidence and achieve their strategic goals. We encourage you to delve deeper into these strategies and adapt them to your unique organizational context. Contact our experts for a consultation on fiscal time of May 2025 and how to optimize your financial strategies.