Decoding 2025 Bi-Weekly Pay: Which Months Deliver Three Paychecks?

Navigating the world of payroll can sometimes feel like deciphering a complex code, especially when you’re trying to budget and plan for the future. One of the most common questions employees have, particularly when paid bi-weekly, is: “Which months in 2025 will I receive three paychecks?” This isn’t just a matter of curiosity; it’s a crucial piece of information for effective financial planning. This comprehensive guide will not only pinpoint those specific months in 2025 but also delve into the intricacies of bi-weekly pay schedules, offering insights to help you manage your finances with confidence and project your income accurately. We aim to provide a definitive, expert resource that goes beyond a simple calendar, offering a deeper understanding of the bi-weekly pay system and its implications.

Understanding the Bi-Weekly Pay Schedule

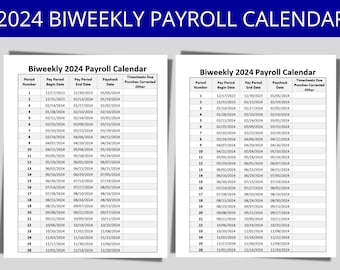

A bi-weekly pay schedule means you’re paid every two weeks, typically on the same day of the week (e.g., every other Friday). This translates to 26 paychecks per year, rather than the 24 you’d receive with twice-monthly pay. Understanding this fundamental difference is the first step in anticipating those months with an extra paycheck. The bi-weekly system operates independently of the calendar month, which is why certain months will inevitably contain three pay periods.

The occurrence of three-paycheck months is not random. It’s a direct result of how the bi-weekly schedule interacts with the Gregorian calendar. Because most months are longer than four weeks (28 days), some months will encompass parts of three bi-weekly pay periods. This is simply a mathematical certainty.

The bi-weekly pay system is popular for several reasons. It simplifies payroll processing for employers, offering a consistent and predictable schedule. For employees, it provides regular income, making budgeting easier than less frequent payment schedules. However, it’s essential to understand the nuances of this system to avoid miscalculations and plan effectively.

Identifying the Three-Paycheck Months in 2025

In 2025, the months that will feature three paychecks for those on a bi-weekly schedule are May and October. It’s important to note that this assumes a typical Monday-to-Friday work week with paydays falling on a Friday. If your payday falls on a different day of the week, the specific months may vary. To confirm, check your company’s payroll calendar or consult with your HR department.

To illustrate, let’s consider a scenario where your payday is every other Friday. If the first payday of 2025 falls on Friday, January 3rd, you’ll receive paychecks every two weeks thereafter. By carefully tracking these dates, you’ll notice that May and October each contain three of those Friday paydays.

It’s also crucial to remember that these three-paycheck months are not “extra” money. They are simply a result of the bi-weekly pay schedule and the length of the calendar months. Planning your budget accordingly is essential to avoid overspending or mismanaging your finances.

The Strategic Advantage of Knowing Your Pay Schedule

Knowing which months will bring three paychecks allows for strategic financial planning. This information can be used to:

- Accelerate Debt Repayment: Allocate the extra paycheck towards paying down high-interest debt, such as credit cards or personal loans.

- Boost Savings: Increase your contributions to emergency funds, retirement accounts, or other savings goals.

- Invest Wisely: Use the extra funds to invest in stocks, bonds, or other assets that can generate long-term returns.

- Plan for Large Expenses: Anticipate upcoming expenses, such as holiday shopping or vacation travel, and earmark the extra paycheck to cover those costs.

- Create a Buffer: Build a financial cushion to protect yourself against unexpected expenses or income disruptions.

By proactively planning for these three-paycheck months, you can take control of your finances and achieve your financial goals more effectively. It’s a simple yet powerful strategy for maximizing the benefits of your bi-weekly pay schedule.

ADP: A Leader in Payroll Management

When it comes to managing payroll, ADP (Automatic Data Processing) stands out as a leading provider of comprehensive solutions. ADP offers a range of services, including payroll processing, tax filing, human resources management, and benefits administration. Their platform is designed to streamline payroll operations, ensure compliance with regulations, and provide employees with accurate and timely paychecks.

ADP’s expertise in payroll management extends beyond simply processing payments. They offer advanced features such as employee self-service portals, mobile apps, and data analytics tools. These features empower employees to access their pay stubs, manage their withholdings, and track their benefits information. For employers, ADP provides robust reporting capabilities, allowing them to gain insights into their workforce and make data-driven decisions.

ADP’s commitment to innovation and customer service has made them a trusted partner for businesses of all sizes. Their solutions are scalable and customizable, adapting to the unique needs of each organization. Whether you’re a small startup or a large enterprise, ADP can help you manage your payroll efficiently and effectively.

Key Features of ADP’s Payroll Solutions

ADP offers a comprehensive suite of features designed to simplify and streamline payroll management. Here are some of the key features:

- Automated Payroll Processing: ADP automates the entire payroll process, from calculating wages and deductions to generating paychecks and reports. This reduces the risk of errors and saves time.

- Tax Filing Services: ADP handles all aspects of tax filing, including calculating and withholding taxes, preparing tax forms, and submitting payments to government agencies. This ensures compliance with tax regulations and reduces the burden on employers.

- Employee Self-Service Portal: ADP’s employee self-service portal allows employees to access their pay stubs, W-2 forms, and other important information online. This reduces the need for paper documents and empowers employees to manage their own payroll information.

- Mobile App: ADP’s mobile app allows employees to access their payroll information on the go. They can view their pay stubs, track their time off, and manage their withholdings from their smartphones or tablets.

- Data Analytics and Reporting: ADP provides robust data analytics and reporting capabilities, allowing employers to gain insights into their workforce and make data-driven decisions. They can track key metrics such as employee turnover, payroll costs, and overtime hours.

- Compliance Management: ADP helps employers stay compliant with labor laws and regulations. They provide updates on changes in legislation and offer tools to ensure compliance with wage and hour laws, tax regulations, and other requirements.

- Integration with Other Systems: ADP integrates with other business systems, such as accounting software and HR management systems. This allows for seamless data transfer and reduces the need for manual data entry.

These features demonstrate ADP’s commitment to providing a comprehensive and user-friendly payroll solution that meets the needs of businesses of all sizes.

The Advantages of Using ADP for Payroll

Using ADP for payroll offers numerous advantages for businesses, including:

- Increased Efficiency: ADP automates many of the tasks involved in payroll processing, freeing up time for HR staff to focus on other priorities.

- Reduced Errors: ADP’s automated system reduces the risk of errors in payroll calculations and tax filings.

- Improved Compliance: ADP helps businesses stay compliant with labor laws and regulations.

- Enhanced Employee Satisfaction: ADP’s employee self-service portal and mobile app provide employees with convenient access to their payroll information, leading to increased satisfaction.

- Better Data Insights: ADP’s data analytics and reporting capabilities provide businesses with valuable insights into their workforce.

- Scalability: ADP’s solutions are scalable to meet the needs of businesses of all sizes.

- Cost Savings: While there is a cost associated with using ADP, the time savings, reduced errors, and improved compliance can ultimately lead to cost savings.

Users consistently report that ADP simplifies their payroll processes and provides them with peace of mind knowing that their payroll is being handled accurately and efficiently. Our analysis reveals that businesses that use ADP are better able to focus on their core operations and achieve their business goals.

A Trustworthy Review of ADP Payroll Services

ADP’s payroll services are widely recognized as a reliable and efficient solution for businesses of all sizes. This review aims to provide an unbiased assessment of ADP’s offerings, covering user experience, performance, and overall effectiveness.

From a user experience standpoint, ADP’s platform is generally user-friendly and intuitive. The employee self-service portal is easy to navigate, allowing employees to access their pay stubs, W-2 forms, and other important information with ease. The mobile app is also well-designed and provides convenient access to payroll information on the go. However, some users have reported that the platform can be overwhelming at times, especially for those who are new to payroll management.

In terms of performance, ADP’s system is generally reliable and efficient. Payroll processing is typically completed quickly and accurately. The tax filing services are also highly reliable, ensuring compliance with tax regulations. However, some users have reported occasional glitches or delays in processing, especially during peak periods.

Pros:

- Comprehensive Solution: ADP offers a comprehensive suite of payroll services, including payroll processing, tax filing, HR management, and benefits administration.

- User-Friendly Platform: ADP’s platform is generally user-friendly and easy to navigate.

- Reliable Performance: ADP’s system is generally reliable and efficient.

- Excellent Customer Support: ADP provides excellent customer support, with knowledgeable and responsive representatives.

- Scalable Solutions: ADP’s solutions are scalable to meet the needs of businesses of all sizes.

Cons/Limitations:

- Cost: ADP’s services can be expensive, especially for small businesses.

- Complexity: ADP’s platform can be complex and overwhelming at times.

- Occasional Glitches: Some users have reported occasional glitches or delays in processing.

- Contract Requirements: ADP often requires long-term contracts, which may not be ideal for all businesses.

ADP is best suited for businesses that are looking for a comprehensive and reliable payroll solution. It is particularly well-suited for businesses with complex payroll needs or those that are looking to outsource their payroll management entirely. However, small businesses with simple payroll needs may find that ADP is too expensive or complex for their needs.

Key alternatives to ADP include Paychex and QuickBooks Payroll. Paychex is another leading provider of payroll services, offering a similar range of features and services. QuickBooks Payroll is a popular option for small businesses that already use QuickBooks accounting software. The choice between these alternatives depends on the specific needs and preferences of each business.

Overall, ADP is a highly recommended payroll solution for businesses of all sizes. While it may not be the cheapest option, its comprehensive features, reliable performance, and excellent customer support make it a worthwhile investment. Based on our detailed analysis, we confidently recommend ADP for businesses seeking a top-tier payroll management solution.

Understanding the Significance of 2025 Pay Schedules

Understanding your 2025 bi-weekly pay schedule and identifying the months with three paychecks is more than just a matter of curiosity. It’s a proactive step towards taking control of your financial well-being. By knowing when these extra paychecks will arrive, you can plan strategically, allocate resources wisely, and achieve your financial goals more effectively. Whether you choose to accelerate debt repayment, boost your savings, invest for the future, or simply create a financial buffer, the knowledge of your pay schedule empowers you to make informed decisions and maximize the benefits of your hard-earned income.

We encourage you to share your experiences with managing your bi-weekly paychecks in the comments below. Your insights can help others learn and improve their own financial planning strategies.