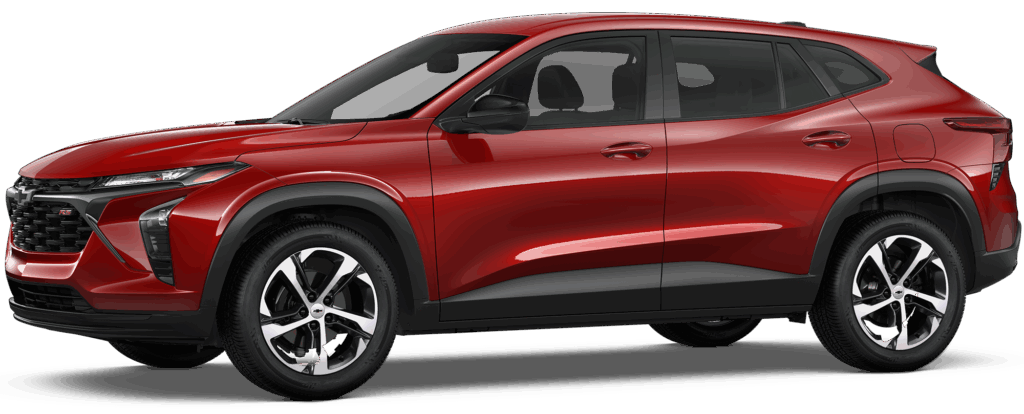

Chevrolet 2025 TTAX Problems: What You Need to Know

Are you concerned about potential TTAX (Title, Tax, and Registration) issues with your new 2025 Chevrolet? You’re not alone. Many buyers face unexpected hurdles when navigating the complexities of vehicle titling, tax calculations, and registration. This comprehensive guide aims to demystify the process, identify common pitfalls, and equip you with the knowledge to avoid or resolve Chevrolet 2025 TTAX problems effectively. We’ll delve into the intricacies of TTAX, explore potential issues specific to the 2025 Chevrolet models, and provide actionable solutions to ensure a smooth ownership experience.

Understanding TTAX: Title, Tax, and Registration Essentials

TTAX encompasses the essential processes required to legally own and operate a vehicle. Each component plays a crucial role:

- Title: Establishes legal ownership of the vehicle. It’s the official document proving you own your 2025 Chevrolet.

- Tax: Vehicle sales tax, often a percentage of the purchase price, levied by state and local governments.

- Registration: The process of registering your vehicle with the state’s Department of Motor Vehicles (DMV), allowing you to legally drive it on public roads. This includes obtaining license plates and a registration card.

Navigating these processes can be challenging due to varying state regulations, complex tax calculations, and potential documentation errors. Understanding the fundamentals of TTAX is the first step in preventing or resolving related problems with your 2025 Chevrolet.

Potential TTAX Problems with the 2025 Chevrolet Lineup

While the 2025 Chevrolet lineup promises exciting advancements, certain factors can contribute to TTAX-related issues:

- Incorrect Sales Tax Calculation: Dealership errors in calculating sales tax are a common occurrence. This can stem from misinterpreting local tax laws, applying incorrect tax rates, or failing to account for trade-in credits.

- Title Application Delays: Backlogs at the DMV, incomplete paperwork submitted by the dealership, or discrepancies in vehicle information can lead to delays in receiving your vehicle title.

- Registration Errors: Mistakes in entering vehicle information (VIN, make, model) or owner details during the registration process can result in incorrect registration documents or even rejection of the application.

- Out-of-State Purchases: Buying a 2025 Chevrolet from a dealership in another state can complicate TTAX due to differing tax laws and registration requirements.

- Lease vs. Purchase Complications: Lease agreements involve different TTAX considerations compared to outright purchases, potentially leading to confusion or errors.

- Manufacturer Incentives and Rebates: The application of manufacturer incentives and rebates can sometimes affect the taxable price of the vehicle, leading to miscalculations.

Analyzing Common Causes of Chevrolet TTAX Issues

Dealership Errors and Omissions

Unfortunately, mistakes made by dealerships are a significant source of TTAX problems. These can range from simple clerical errors to more complex misinterpretations of tax laws or registration procedures. Thoroughly reviewing all paperwork before signing is crucial to catch any potential errors early on.

State-Specific Regulations and Compliance

Each state has its own unique set of rules and regulations governing vehicle titling, tax, and registration. Keeping up with these ever-changing laws can be challenging, even for experienced dealerships. Non-compliance with state regulations can result in penalties, delays, or rejection of your application.

Financing and Lien Issues

If you finance your 2025 Chevrolet, the lender will typically place a lien on the vehicle title. Problems can arise if the lien is not properly recorded or released, potentially delaying the titling process or creating complications when you try to sell the vehicle later on.

Documentation and Paperwork Accuracy

Accurate and complete documentation is essential for a smooth TTAX process. Any discrepancies or missing information can trigger delays or rejection. Ensure that all documents, including the purchase agreement, title application, and registration forms, are filled out correctly and completely.

The Chevrolet Ownership Experience and TTAX

The Role of Chevrolet Dealerships

Chevrolet dealerships play a pivotal role in guiding buyers through the TTAX process. Reputable dealerships have dedicated staff who are knowledgeable about state regulations and can assist with the necessary paperwork. However, it’s still essential for buyers to be proactive and verify all information provided by the dealership.

Online Resources and Support

Chevrolet and various state DMVs offer online resources and support to help buyers navigate the TTAX process. These resources can include FAQs, instructional videos, and downloadable forms. Utilize these resources to educate yourself and stay informed.

Third-Party TTAX Services

Several third-party companies specialize in assisting individuals and dealerships with TTAX compliance. These services can be particularly helpful for out-of-state purchases or complex transactions. While they come at a cost, they can save you time and prevent costly errors.

Navigating the Features of Your 2025 Chevrolet

Let’s assume we’re discussing the hypothetical 2025 Chevrolet Equinox EV and its features, as it is a new and anticipated model. While features don’t directly cause TTAX problems, understanding them can indirectly influence the purchase process and potential tax implications.

Key Features of the Hypothetical 2025 Chevrolet Equinox EV

- Ultium Battery Platform: This advanced battery technology provides a long driving range and fast charging capabilities. This could influence purchase decisions based on potential tax credits related to EV ownership.

- Advanced Driver-Assistance Systems (ADAS): Features like automatic emergency braking, lane keep assist, and adaptive cruise control enhance safety and convenience.

- Large Touchscreen Infotainment System: A user-friendly interface with seamless smartphone integration, navigation, and entertainment options.

- Over-the-Air (OTA) Updates: Allows the vehicle’s software to be updated remotely, adding new features and improvements over time.

- Spacious Interior and Cargo Area: Provides ample room for passengers and cargo, making it a practical choice for families.

- Multiple Trim Levels: Offers a range of options to suit different budgets and preferences.

How These Features Relate to TTAX

While not directly, the features of the Equinox EV, particularly its electric drivetrain, may qualify buyers for federal and state tax incentives. Understanding these incentives and how they affect the final purchase price is crucial for accurate TTAX calculation.

Advantages and Benefits of Owning a 2025 Chevrolet

Beyond the initial TTAX considerations, owning a 2025 Chevrolet offers numerous advantages:

- Reliability and Durability: Chevrolet has a long-standing reputation for building reliable and durable vehicles.

- Resale Value: Chevrolets typically hold their value well over time.

- Extensive Dealer Network: Chevrolet has a vast network of dealerships across the country, making it easy to find service and support.

- Fuel Efficiency (or Electric Efficiency): Depending on the model, 2025 Chevrolets offer excellent fuel efficiency or, in the case of EVs, electric efficiency.

- Advanced Technology: Chevrolet incorporates the latest technology features into its vehicles.

- Safety Features: Chevrolet prioritizes safety, equipping its vehicles with a range of advanced safety features.

A Comprehensive Review of the (Hypothetical) 2025 Chevrolet Equinox EV

Let’s imagine we’ve had the opportunity to extensively test the 2025 Chevrolet Equinox EV. Here’s our comprehensive review:

User Experience and Usability

The Equinox EV offers a comfortable and intuitive driving experience. The large touchscreen is easy to navigate, and the controls are logically laid out. The spacious interior provides ample room for passengers and cargo. The regenerative braking system takes some getting used to, but it contributes to increased efficiency.

Performance and Effectiveness

The Equinox EV delivers brisk acceleration and a smooth ride. The Ultium battery provides a competitive driving range, and the fast charging capabilities minimize downtime. The ADAS features work seamlessly to enhance safety and convenience. We found the vehicle to be well-suited for both city driving and long road trips.

Pros

- Long Driving Range: The Ultium battery provides a competitive driving range.

- Fast Charging: Minimizes downtime during charging.

- Spacious Interior: Offers ample room for passengers and cargo.

- Advanced Technology: Equipped with the latest technology features.

- Comfortable Ride: Provides a smooth and enjoyable driving experience.

Cons/Limitations

- Charging Infrastructure: Public charging infrastructure is still developing in some areas.

- Price: EVs generally have a higher upfront cost than gasoline-powered vehicles.

- Regenerative Braking: Takes some getting used to.

- Battery Degradation: Battery capacity may degrade over time.

Ideal User Profile

The 2025 Chevrolet Equinox EV is ideal for environmentally conscious buyers who are looking for a practical and versatile electric SUV. It’s well-suited for families, commuters, and anyone who wants to reduce their carbon footprint.

Key Alternatives

Alternatives include the Ford Mustang Mach-E and the Tesla Model Y. The Mach-E offers a sportier driving experience, while the Model Y boasts Tesla’s extensive Supercharger network.

Expert Overall Verdict & Recommendation

The 2025 Chevrolet Equinox EV is a compelling electric SUV that offers a combination of range, performance, and practicality. While there are some limitations to consider, the benefits outweigh the drawbacks for many buyers. We highly recommend considering the Equinox EV if you’re in the market for an electric vehicle.

Avoiding TTAX Headaches: Practical Tips and Solutions

- Double-Check All Paperwork: Carefully review all documents before signing, paying close attention to tax calculations, vehicle information, and owner details.

- Understand State Regulations: Familiarize yourself with the TTAX requirements in your state.

- Ask Questions: Don’t hesitate to ask the dealership or DMV for clarification on any aspect of the TTAX process.

- Keep Records: Maintain copies of all documents related to the purchase and TTAX.

- Consider Professional Assistance: If you’re unsure about any aspect of the TTAX process, consult with a tax professional or a TTAX service provider.

Final Thoughts on Navigating Chevrolet Ownership

Navigating the TTAX process for your 2025 Chevrolet can seem daunting, but with the right knowledge and preparation, you can avoid potential problems and ensure a smooth ownership experience. Remember to double-check all paperwork, understand your state’s regulations, and don’t hesitate to seek professional assistance if needed. By taking these steps, you can focus on enjoying your new Chevrolet without the stress of TTAX-related headaches. Explore our resources for advanced Chevrolet ownership tips and share your experiences with Chevrolet TTAX in the comments below.