Unlocking the Future: A Comprehensive MJNA Stock Prediction Analysis

Navigating the stock market can feel like charting unknown waters, especially when it comes to emerging sectors and less-established companies. If you’re researching MJNA stock prediction, you’re likely seeking clarity and a reliable forecast for this particular equity. This comprehensive guide aims to provide just that – a deep dive into the factors influencing MJNA’s potential trajectory, expert analysis of market trends, and a balanced perspective on the opportunities and risks involved. We’ll explore the underlying business, analyze its financial health, and consider the broader market forces at play, equipping you with the knowledge to make informed decisions.

Understanding the Landscape of MJNA Stock Prediction

MJNA stock prediction isn’t a simple task. It requires a nuanced understanding of several key areas. Firstly, you need a solid grasp of the company’s core business – what products or services does it offer, and what market does it serve? Secondly, a thorough financial analysis is crucial. This involves examining the company’s revenue, profitability, debt levels, and cash flow. Thirdly, the broader macroeconomic environment plays a significant role. Factors such as interest rates, inflation, and overall economic growth can all impact stock prices. Finally, understanding investor sentiment and market trends is essential. Are investors generally optimistic or pessimistic about the company’s prospects? What are the prevailing trends in the industry?

Predicting stock prices is not an exact science. Many external factors can dramatically change stock performance. However, a structured approach that considers all these elements can significantly improve the accuracy of your predictions.

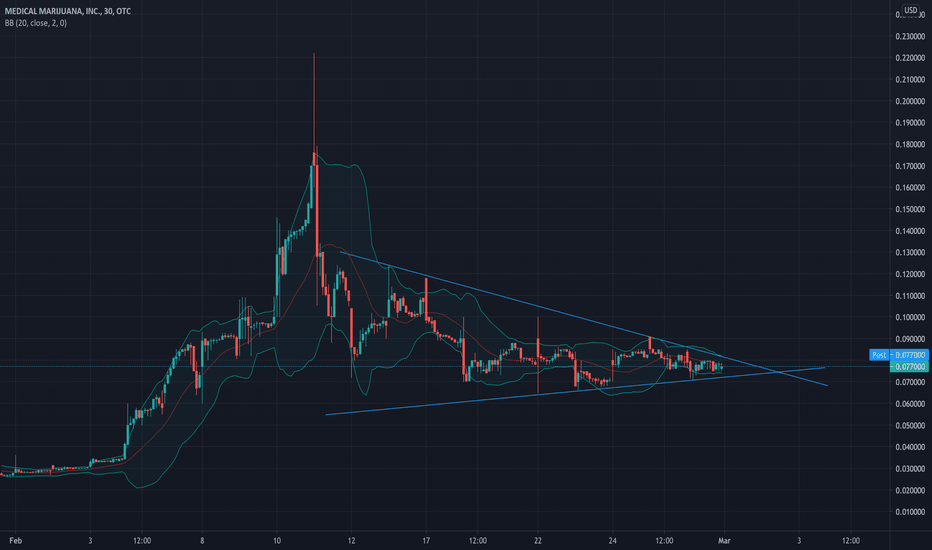

The Role of Technical Analysis in MJNA Stock Prediction

Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. Technical analysts use charts and other tools to identify patterns that can help them predict future price movements. While technical analysis can be a useful tool, it’s important to remember that it’s not foolproof. Past performance is not necessarily indicative of future results.

Fundamental Analysis: A Cornerstone of Long-Term MJNA Stock Prediction

Fundamental analysis, on the other hand, focuses on evaluating a company’s intrinsic value by examining its financial statements, industry trends, and competitive landscape. This approach seeks to determine whether a stock is undervalued or overvalued by the market. For long-term investors, fundamental analysis is often considered a more reliable approach than technical analysis.

The Significance of News and Events

News and events can have a significant impact on stock prices, especially in the short term. Positive news, such as a new product launch or a favorable earnings report, can cause a stock price to rise. Conversely, negative news, such as a product recall or a disappointing earnings report, can cause a stock price to fall. Staying informed about the latest news and events related to MJNA is crucial for accurate stock prediction.

Deep Dive: Medical Marijuana, Inc. (MJNA) and Its Position in the Market

Medical Marijuana, Inc. (MJNA) operates within the burgeoning cannabis industry, specifically focusing on hemp-derived cannabidiol (CBD) products. Understanding its specific niche is crucial for anyone engaging in MJNA stock prediction. Unlike companies directly involved in marijuana cultivation and distribution (which face varying legal restrictions), MJNA focuses on the legal and widely accessible CBD market. This distinction is paramount when assessing its growth potential and risk factors.

MJNA operates through a portfolio of subsidiary companies, each specializing in different aspects of the CBD market, from product development and manufacturing to marketing and distribution. This diversified approach aims to capture a wider share of the market and mitigate risks associated with relying on a single product or channel.

The regulatory landscape surrounding CBD products is constantly evolving, and MJNA must navigate these changes effectively to maintain its competitive advantage. Staying abreast of legislative developments at both the state and federal levels is crucial for assessing the long-term viability of MJNA’s business model.

Product Spotlight: HempMeds® and Its Role in MJNA’s Portfolio

HempMeds® is a key brand within the Medical Marijuana, Inc. (MJNA) family of companies. It represents a significant portion of MJNA’s revenue and market presence. HempMeds® focuses on producing and distributing a range of CBD products, including tinctures, capsules, topicals, and edibles. These products are marketed towards consumers seeking natural wellness solutions for various health concerns, such as pain management, anxiety relief, and improved sleep.

HempMeds® distinguishes itself through its commitment to quality and transparency. The company emphasizes rigorous testing and quality control measures throughout its production process, from sourcing hemp to manufacturing finished products. This focus on quality is essential for building consumer trust and maintaining a strong brand reputation in a competitive market.

HempMeds® products are widely available online and through select retail partners. The company utilizes various marketing strategies to reach its target audience, including social media campaigns, influencer partnerships, and content marketing. The success of HempMeds® is directly linked to the overall performance of MJNA stock, making it a critical area of focus for investors.

Analyzing Key Features of HempMeds® CBD Products

HempMeds® offers a diverse range of CBD products, each with unique features designed to cater to different consumer preferences and needs. Here’s a breakdown of some key features:

- Full-Spectrum CBD: Many HempMeds® products contain full-spectrum CBD, meaning they include all the naturally occurring cannabinoids, terpenes, and other beneficial compounds found in the hemp plant. This is believed to enhance the entourage effect, where these compounds work synergistically to provide greater therapeutic benefits.

- Third-Party Lab Testing: All HempMeds® products undergo rigorous third-party lab testing to ensure potency, purity, and safety. These tests verify the CBD content and confirm that the products are free from contaminants such as pesticides, heavy metals, and residual solvents. This commitment to transparency builds consumer trust and provides assurance of product quality.

- Variety of Formulations: HempMeds® offers a variety of product formulations, including tinctures, capsules, topicals, and edibles. This allows consumers to choose the delivery method that best suits their needs and preferences. For example, tinctures offer fast absorption, while capsules provide a convenient and discreet option.

- Different Potencies: HempMeds® products are available in a range of potencies, allowing consumers to customize their dosage based on their individual needs and tolerance levels. This is particularly important for those who are new to CBD and want to start with a low dose.

- Organic Hemp Sourcing: HempMeds® sources its hemp from farms that adhere to organic farming practices. This ensures that the hemp is grown without the use of harmful pesticides or herbicides, resulting in a cleaner and more sustainable product.

- CO2 Extraction: HempMeds® utilizes CO2 extraction, a state-of-the-art method for extracting CBD from the hemp plant. This method is considered to be safe, efficient, and environmentally friendly, as it does not involve the use of harsh solvents.

- Targeted Formulations: Some HempMeds® products are specifically formulated to address particular health concerns, such as sleep problems or muscle soreness. These targeted formulations often contain additional ingredients that work synergistically with CBD to provide enhanced benefits.

The Advantages and Real-World Value of Investing in MJNA

Investing in MJNA, or any stock, requires careful consideration of its potential advantages and real-world value. For MJNA, these include exposure to the growing CBD market, a diversified business model, and a focus on quality and transparency. However, it’s also crucial to acknowledge the risks associated with investing in a relatively young and volatile industry.

One of the primary advantages of investing in MJNA is its exposure to the rapidly expanding CBD market. As consumer awareness of CBD’s potential health benefits grows, the demand for CBD products is expected to continue to increase. MJNA, with its established brand and diversified product portfolio, is well-positioned to capitalize on this growth.

The company’s diversified business model, with its portfolio of subsidiary companies, helps to mitigate risks associated with relying on a single product or channel. This allows MJNA to adapt to changing market conditions and capitalize on new opportunities as they arise.

MJNA’s commitment to quality and transparency is another significant advantage. By emphasizing rigorous testing and quality control measures, the company builds consumer trust and differentiates itself from competitors who may cut corners on quality. This focus on quality can lead to increased brand loyalty and long-term growth.

However, it’s important to acknowledge the risks associated with investing in MJNA. The cannabis industry is still relatively young and faces regulatory uncertainties. Changes in laws and regulations could significantly impact MJNA’s business model. Additionally, the market is becoming increasingly competitive, with new players entering the market all the time. MJNA must continue to innovate and differentiate itself to maintain its competitive advantage.

Ultimately, the decision to invest in MJNA depends on your individual risk tolerance and investment goals. It’s essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

A Trustworthy Review of Medical Marijuana, Inc. (MJNA)

Medical Marijuana, Inc. (MJNA) presents a complex investment picture. A balanced review requires an objective look at its strengths and weaknesses, considering both potential and limitations.

From a user experience perspective, interacting with MJNA is primarily through its subsidiary brands like HempMeds®. The online shopping experience is generally smooth, with clear product information and secure checkout processes. However, navigating the complex corporate structure can be confusing for some consumers and investors alike.

In terms of performance, MJNA has demonstrated consistent revenue growth in recent years, driven by the increasing demand for CBD products. However, profitability has been a challenge, as the company has faced significant operating expenses and regulatory hurdles. Whether it can achieve sustained profitability remains a key question for investors.

Pros:

- First-Mover Advantage: MJNA was one of the first publicly traded companies in the cannabis industry, giving it a significant head start in building brand recognition and market share.

- Diversified Product Portfolio: The company’s portfolio of subsidiary companies offers a wide range of CBD products, catering to different consumer needs and preferences.

- Focus on Quality: MJNA emphasizes rigorous testing and quality control measures, building consumer trust and differentiating itself from competitors.

- Established Distribution Network: The company has established a robust distribution network, reaching consumers online and through select retail partners.

- Strong Brand Recognition: Brands like HempMeds® have become well-known and respected in the CBD market.

Cons/Limitations:

- Regulatory Uncertainty: The cannabis industry faces ongoing regulatory uncertainties, which could impact MJNA’s business model.

- Competition: The CBD market is becoming increasingly competitive, with new players entering the market all the time.

- Profitability Challenges: MJNA has struggled to achieve sustained profitability, despite consistent revenue growth.

- Complex Corporate Structure: The company’s complex corporate structure can be confusing for some investors.

MJNA is best suited for investors with a high-risk tolerance who are willing to invest in a volatile and rapidly evolving industry. Investors should be prepared for potential ups and downs and should not invest more than they can afford to lose.

Key alternatives to MJNA include other publicly traded cannabis companies, such as Canopy Growth Corporation and Aurora Cannabis. However, these companies are primarily focused on marijuana cultivation and distribution, rather than CBD products. Another alternative is investing in pure-play CBD companies, but these companies may be smaller and less established than MJNA.

Overall, MJNA presents a mixed bag of opportunities and risks. While the company has a strong brand, a diversified product portfolio, and a focus on quality, it also faces regulatory uncertainties, competition, and profitability challenges. Investors should carefully weigh these factors before making any investment decisions. Our overall verdict is that while MJNA has potential, it requires careful monitoring and a high-risk tolerance.

Answers to Your MJNA Stock Prediction Questions

Here are some common questions and expert answers regarding MJNA stock prediction:

-

What are the primary factors influencing MJNA’s stock price?

MJNA’s stock price is primarily influenced by the overall performance of the CBD market, regulatory developments, the company’s financial performance (revenue, profitability), and investor sentiment. Positive news regarding CBD research or favorable regulatory changes can boost the stock price, while negative news or disappointing earnings reports can have the opposite effect.

-

Is technical analysis a reliable method for MJNA stock prediction?

Technical analysis can be a useful tool for short-term MJNA stock prediction, but it should not be relied upon solely. Technical analysis involves analyzing past price and volume data to identify patterns that may indicate future price movements. However, MJNA’s stock price can be highly volatile and influenced by external factors that are not reflected in historical data. Therefore, it’s essential to combine technical analysis with fundamental analysis and a thorough understanding of the company’s business and the CBD market.

-

How does the regulatory environment impact MJNA stock prediction?

The regulatory environment has a significant impact on MJNA stock prediction. The legal status of CBD products varies by state and country, and changes in laws and regulations can significantly impact MJNA’s ability to operate and sell its products. Positive regulatory developments, such as the legalization of CBD at the federal level, could boost the stock price, while negative developments, such as increased restrictions on CBD sales, could have the opposite effect.

-

What are the key risks associated with investing in MJNA?

The key risks associated with investing in MJNA include regulatory uncertainty, competition, profitability challenges, and the company’s complex corporate structure. The cannabis industry is still relatively young and faces ongoing regulatory uncertainties. The CBD market is becoming increasingly competitive, with new players entering the market all the time. MJNA has struggled to achieve sustained profitability, despite consistent revenue growth. And the company’s complex corporate structure can be confusing for some investors.

-

What is the long-term outlook for MJNA stock?

The long-term outlook for MJNA stock is uncertain. The company’s success depends on its ability to navigate the regulatory landscape, compete effectively in the CBD market, and achieve sustained profitability. If MJNA can successfully execute its business strategy, the stock has the potential to generate significant returns for investors. However, there are also significant risks associated with investing in MJNA, and investors should be prepared for potential ups and downs.

-

How does MJNA’s focus on CBD differentiate it from other cannabis stocks?

MJNA’s focus on CBD, rather than marijuana, provides a degree of insulation from the stricter regulations surrounding marijuana cultivation and sales. CBD derived from hemp is federally legal in the United States, making MJNA’s business model more stable than those of companies directly involved in marijuana. This differentiation is crucial for investors seeking exposure to the cannabis industry with lower regulatory risk.

-

What role does HempMeds® play in MJNA’s overall financial health?

HempMeds® is a significant revenue driver for MJNA. Its success in marketing and selling CBD products directly impacts MJNA’s financial performance. Investors closely monitor HempMeds®’ sales figures and market share to gauge the overall health and growth potential of MJNA.

-

How does MJNA ensure the quality and safety of its CBD products?

MJNA emphasizes rigorous third-party lab testing to ensure the potency, purity, and safety of its CBD products. These tests verify the CBD content and confirm that the products are free from contaminants. This commitment to quality is essential for building consumer trust and maintaining a strong brand reputation.

-

What are some potential catalysts that could drive MJNA’s stock price higher?

Potential catalysts that could drive MJNA’s stock price higher include positive regulatory developments (e.g., federal legalization of CBD), successful new product launches, expansion into new markets, and improved profitability.

-

Where can investors find reliable information and analysis on MJNA stock?

Investors can find reliable information and analysis on MJNA stock from reputable financial news websites, investment research firms, and the company’s investor relations website. It’s important to consult a variety of sources and conduct thorough research before making any investment decisions.

Making Informed Decisions About MJNA Stock

Predicting the future of any stock, including MJNA, is inherently challenging. However, by understanding the company’s business model, analyzing its financial performance, and staying abreast of industry trends and regulatory developments, investors can make more informed decisions. MJNA offers exposure to the growing CBD market, but it also faces significant risks. A balanced perspective, coupled with thorough research, is essential for navigating the complexities of MJNA stock prediction.

We encourage you to share your own insights and experiences with MJNA in the comments below. Your contributions can help create a more informed and valuable resource for all investors.