MJNA Stock Prediction: Unveiling the Future of Marijuana Stocks

The allure of the marijuana industry, with its promise of exponential growth, has drawn countless investors to stocks like MJNA. But navigating this volatile market requires more than just optimism; it demands a strategic approach grounded in thorough research and informed predictions. If you’re seeking clarity on the future of MJNA stock, you’ve come to the right place. This comprehensive guide delves into the intricacies of MJNA stock prediction, providing you with the knowledge and insights needed to make sound investment decisions. We aim to go beyond surface-level analysis, offering a detailed examination of the factors influencing MJNA’s performance and exploring various forecasting methodologies.

Understanding MJNA and the Cannabis Market Landscape

MJNA, often associated with various companies in the cannabis sector, operates within a complex and rapidly evolving market. Before diving into predictions, it’s crucial to understand the fundamentals. The cannabis industry is influenced by a multitude of factors, including changing regulations, consumer demand, and technological advancements in cultivation and product development.

The legal landscape for cannabis varies significantly across different regions and countries. This creates both opportunities and challenges for companies like MJNA. In regions where cannabis is legal for medical or recreational use, MJNA may experience growth in sales and market share. However, in regions where cannabis remains illegal, MJNA may face limitations and restrictions.

Consumer demand for cannabis products is also a key driver of MJNA’s performance. As more people become aware of the potential benefits of cannabis, demand for various cannabis products, such as CBD oils, edibles, and vape cartridges, is likely to increase. MJNA needs to adapt to these changing consumer preferences and develop innovative products to meet the evolving needs of the market.

Technological advancements in cultivation and product development are also playing a significant role in the cannabis industry. New technologies are enabling companies like MJNA to produce higher-quality cannabis products at lower costs. These advancements are also leading to the development of new and innovative cannabis products, such as cannabis-infused beverages and topicals.

The Role of Predictive Analysis in Stock Forecasting

Predictive analysis is a powerful tool that can be used to forecast the future performance of stocks like MJNA. This involves using historical data, statistical models, and machine learning algorithms to identify patterns and trends that can be used to predict future stock prices. However, it’s important to recognize that stock predictions are not guaranteed to be accurate, and there is always a risk of loss when investing in the stock market.

Several factors can influence the accuracy of stock predictions. These include the quality of the data used, the complexity of the models used, and the overall volatility of the market. It’s also important to consider external factors, such as economic conditions, political events, and industry trends, which can have a significant impact on stock prices.

Despite these challenges, predictive analysis can still be a valuable tool for investors. By using a combination of historical data, statistical models, and expert analysis, investors can gain a better understanding of the potential risks and rewards associated with investing in MJNA stock. This can help them make more informed investment decisions and improve their chances of achieving their financial goals.

Key Factors Influencing MJNA Stock Performance

Predicting the future of MJNA stock requires a comprehensive understanding of the numerous factors that can influence its performance. These factors can be broadly categorized into internal and external influences.

Internal Factors

- Company Financial Health: Revenue growth, profitability, debt levels, and cash flow are critical indicators of MJNA’s financial stability and potential for future growth. A strong balance sheet and consistent revenue growth are positive signs for investors.

- Management Team: The experience, expertise, and strategic vision of MJNA’s management team play a crucial role in the company’s success. A competent and experienced management team can navigate the challenges of the cannabis industry and capitalize on emerging opportunities.

- Product Portfolio: The diversity and quality of MJNA’s product offerings are essential for attracting and retaining customers. A strong product portfolio that caters to different consumer preferences can help MJNA maintain its competitive edge.

- Operational Efficiency: Efficient operations, including cultivation, manufacturing, and distribution, are crucial for maximizing profitability and minimizing costs. Streamlined processes and effective supply chain management can improve MJNA’s bottom line.

External Factors

- Regulatory Environment: Changes in cannabis regulations at the federal, state, and local levels can significantly impact MJNA’s operations and financial performance. Favorable regulatory changes can create new opportunities, while unfavorable changes can pose challenges.

- Market Competition: The cannabis industry is becoming increasingly competitive, with new players entering the market regularly. MJNA needs to differentiate itself from its competitors and maintain its market share.

- Economic Conditions: Economic factors, such as inflation, interest rates, and consumer spending, can influence the demand for cannabis products. A strong economy can boost consumer spending and increase demand for MJNA’s products.

- Social and Political Trends: Changing social attitudes towards cannabis and political support for cannabis legalization can impact MJNA’s long-term prospects. Growing acceptance of cannabis can lead to increased demand and favorable regulatory changes.

Analyzing Financial Statements for MJNA Stock Prediction

A thorough analysis of MJNA’s financial statements is essential for making informed stock predictions. Key financial statements to examine include the income statement, balance sheet, and cash flow statement.

- Income Statement: The income statement provides information about MJNA’s revenues, expenses, and profits over a specific period. Analyzing trends in revenue growth, gross profit margin, and net income can provide insights into the company’s profitability and efficiency.

- Balance Sheet: The balance sheet provides a snapshot of MJNA’s assets, liabilities, and equity at a specific point in time. Analyzing trends in assets, liabilities, and equity can provide insights into the company’s financial health and solvency.

- Cash Flow Statement: The cash flow statement provides information about MJNA’s cash inflows and outflows over a specific period. Analyzing trends in cash flow from operations, investing, and financing can provide insights into the company’s liquidity and ability to generate cash.

By carefully analyzing these financial statements, investors can gain a better understanding of MJNA’s financial performance and identify potential risks and opportunities.

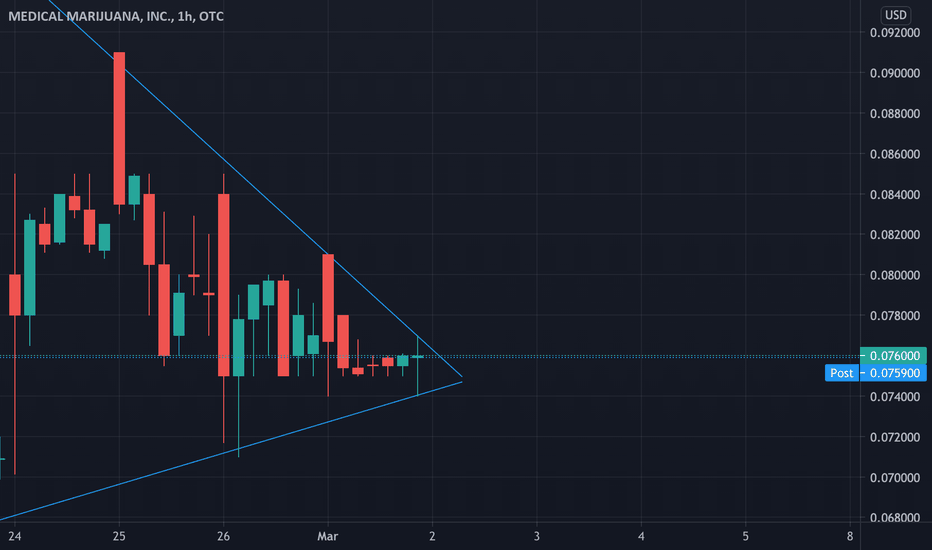

Technical Analysis for MJNA Stock Prediction

Technical analysis involves using historical price and volume data to identify patterns and trends that can be used to predict future stock prices. Technical analysts use a variety of tools and techniques, such as charts, indicators, and oscillators, to analyze stock price movements and identify potential trading opportunities.

Some common technical indicators used in MJNA stock prediction include:

- Moving Averages: Moving averages smooth out price fluctuations and can help identify trends.

- Relative Strength Index (RSI): RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Moving Average Convergence Divergence (MACD): MACD identifies changes in the strength, direction, momentum, and duration of a trend in a stock’s price.

- Bollinger Bands: Bollinger Bands measure the volatility of a stock’s price and can help identify potential breakout or breakdown points.

Technical analysis can be a valuable tool for identifying short-term trading opportunities in MJNA stock. However, it’s important to remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis.

Fundamental Analysis for MJNA Stock Prediction

Fundamental analysis involves evaluating a company’s intrinsic value by examining its financial statements, industry trends, and economic conditions. Fundamental analysts use a variety of techniques, such as discounted cash flow analysis and relative valuation, to estimate a company’s fair value.

Key factors to consider in fundamental analysis of MJNA include:

- Revenue Growth: Is MJNA experiencing consistent revenue growth?

- Profitability: Is MJNA profitable? What are its gross profit margin and net profit margin?

- Debt Levels: Does MJNA have a manageable level of debt?

- Cash Flow: Is MJNA generating positive cash flow?

- Industry Trends: What are the key trends in the cannabis industry?

- Regulatory Environment: What is the regulatory environment for cannabis in the regions where MJNA operates?

Fundamental analysis can be a valuable tool for identifying undervalued or overvalued stocks. By comparing a company’s intrinsic value to its current market price, investors can make informed decisions about whether to buy, sell, or hold the stock.

The Impact of Regulatory Changes on MJNA Stock

The regulatory landscape is arguably the most significant factor affecting MJNA stock. Shifts in cannabis laws can dramatically alter the company’s prospects, both positively and negatively. For instance, federal legalization in the United States would likely trigger a surge in MJNA’s stock price, opening up new markets and investment opportunities. Conversely, stricter regulations in key markets could hinder growth and depress the stock’s value.

Investors must closely monitor regulatory developments at the federal, state, and international levels to assess the potential impact on MJNA. This includes tracking legislation, regulatory rulings, and policy changes that could affect the company’s operations and financial performance. Staying informed about these developments is crucial for making informed investment decisions.

Crowd Sentiment Analysis and MJNA Stock

Crowd sentiment, often gauged through social media, online forums, and news articles, can provide valuable insights into the potential direction of MJNA stock. A surge in positive sentiment, driven by favorable news or social media buzz, can often lead to an increase in buying pressure and a rise in the stock price. Conversely, negative sentiment can trigger selling pressure and a decline in the stock’s value.

However, it’s important to approach crowd sentiment analysis with caution. While it can be a useful indicator, it’s not always reliable. Sentiment can be easily manipulated or influenced by short-term events, and it’s essential to consider it in conjunction with other forms of analysis. Tools like sentiment analysis software can help aggregate and interpret the vast amounts of online data, providing a more nuanced understanding of market sentiment.

Risk Factors to Consider When Investing in MJNA

Investing in MJNA stock, like any investment, involves inherent risks. It’s crucial to be aware of these risks before making any investment decisions.

- Regulatory Risk: Changes in cannabis regulations can significantly impact MJNA’s operations and financial performance.

- Market Risk: The cannabis industry is highly volatile, and MJNA’s stock price can be affected by market fluctuations.

- Competition Risk: The cannabis industry is becoming increasingly competitive, and MJNA faces competition from other companies.

- Financial Risk: MJNA’s financial performance can be affected by factors such as debt levels, cash flow, and profitability.

- Operational Risk: MJNA’s operations can be affected by factors such as cultivation challenges, manufacturing issues, and distribution problems.

By understanding these risks, investors can make more informed decisions about whether to invest in MJNA stock and how much to invest.

Alternative Investments in the Cannabis Sector

While MJNA may be an option, the cannabis sector offers a variety of alternative investment opportunities. These include other cannabis stocks, cannabis ETFs, and private cannabis companies. Diversifying your investments across different cannabis companies and investment vehicles can help mitigate risk and increase your chances of success.

Some popular cannabis ETFs include:

- AdvisorShares Pure Cannabis ETF (YOLO)

- ETFMG Alternative Harvest ETF (MJ)

- Canopy Growth Corporation (WEED)

Before investing in any cannabis investment, it’s important to conduct thorough research and consult with a financial advisor to determine if it’s the right fit for your investment goals and risk tolerance.

A Look Ahead: Projecting MJNA’s Future Trajectory

Predicting the future of any stock with certainty is impossible, but by carefully analyzing the factors discussed above, we can develop a more informed perspective on MJNA’s potential trajectory. The future of MJNA hinges on a complex interplay of regulatory changes, market dynamics, and the company’s ability to execute its strategic vision.

While challenges undoubtedly exist, the long-term outlook for the cannabis industry remains positive. As more regions legalize cannabis and consumer acceptance grows, companies like MJNA are poised to benefit. However, success will require adaptability, innovation, and a strong focus on operational efficiency.

Navigating the MJNA Stock Landscape: A Final Thought

Investing in the stock market, particularly in a dynamic sector like cannabis, carries inherent risks. Before making any investment decisions regarding MJNA, it’s crucial to conduct thorough research, consult with a qualified financial advisor, and carefully consider your own risk tolerance and investment objectives. By taking a disciplined and informed approach, you can navigate the MJNA stock landscape with greater confidence and increase your chances of achieving your financial goals. The insights shared here provide a foundation for your own analysis, but should not replace professional financial advice tailored to your specific circumstances.